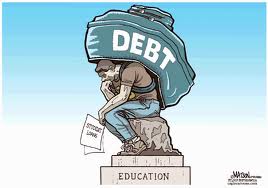

The Next Big Crisis – Student Loan Debt

While a college education remains a worthwhile investment overall, the statistics are quite alarming. The average borrower now graduates with over $26,000 in debt, and only 58% of full-time students, who began college in 2004, earned a four-year degree within six years. Worst of all, in this lingering recession, many students are not finding the jobs that are necessary to repay their student loan debt.

If graduates can’t find jobs, they will default on their loans and the collective impact has the potential to damage the already-weak economy at an unthinkable magnitude. The Federal Reserve’s Board of Governors warned that student-loan debt has “parallels to the housing crisis,” with some very important distinctions that could make it even more devastating. One important distinction is that you can give up your house if you can’t pay for it, or you can potentially write off your debt in bankruptcy. Neither is a way out of student loan debt. Even in the event of your death, if you have a cosigner, your student loan debt passes to the cosigner.

Another differentiator is that home buyers have been able to get loans in the 3-5% interest rate range for the last several years. As of today, Sallie Mae, the nation’s largest student loan company publishes that “variable rates range from 2.25% APR to 9.37% APR; and fixed interest rates range from 5.74% APR to 11.85% APR”. Considering that there is little risk that you will not repay the loan over your lifetime, the rates can be considered usury. To add insult to injury, the Huffington Post reported this week that “Sen. Elizabeth Warren (D-Mass.) has criticized Sallie Mae’s use of a taxpayer-subsidized line of credit that has allowed it to borrow cheaply without passing on the benefits to students.”

Now, let’s take a look at the scale of student loans. In the past 15 years, student loans have nearly tripled. Student loan debt in this country has reached over $1 trillion, and now exceeds credit card debt as the largest form of unsecured debt. The Bureau of Labor Statistics says that as of 2011, 25.5% of recent college graduates were jobless, and according to the Consumer Finance Protection Bureau, 10% of recent graduates from 4-year colleges owe monthly student loan payments exceeding 25% of their incomes. This all results in life-long debt struggles; borrowers in their 30s have a delinquency rate (more than 90 days past due) of about 6%, while borrowers in their 40s have a delinquency rate double that, at about 12%.

Christopher Matthews describes what this loan crash might look like in a NY Times article, “The thing is, the student loan industry can’t crash, pop, fizzle, or otherwise suddenly deflate because the Department of Education backs at least 85% of all student loans. Of the remaining loans that are privately issued, 90% have cosigners. On top of that, it’s nearly impossible for student loan debt — whether owed to the government or to private lenders — to be discharged during bankruptcy.”

So, why is the cost of college so high? There is a school of thought that says the cost of college is artificially high due to the seemingly endless flow of government money that is put toward education. Many schools spend those dollars irrationally, and it forces other colleges to keep pace in order to attract students who have been given loans. According to a Bloomberg report, “The bankers said student lending shares features of the housing crisis including ‘significant growth of subsidized lending in pursuit of a social good,’ in this case higher education instead of expanded home ownership…The lending has put upward pressure on tuition, just as the mortgage lending boom led to rising home prices, they said, calling both examples of a ‘lack of underwriting discipline.”

So, why is the cost of college so high? There is a school of thought that says the cost of college is artificially high due to the seemingly endless flow of government money that is put toward education. Many schools spend those dollars irrationally, and it forces other colleges to keep pace in order to attract students who have been given loans. According to a Bloomberg report, “The bankers said student lending shares features of the housing crisis including ‘significant growth of subsidized lending in pursuit of a social good,’ in this case higher education instead of expanded home ownership…The lending has put upward pressure on tuition, just as the mortgage lending boom led to rising home prices, they said, calling both examples of a ‘lack of underwriting discipline.”

“We will provide the support necessary for you to complete college and meet a new goal: by 2020, America will once again have the highest proportion of college graduates in the world.” – President Barack Obama February 24, 2009

Think about it…when you went on all those college tours, they were marketing to us, at 17 or 18 years old. Most college information sessions were stressing sports; social life; the food; the dorms; things to do in local area…I never remember anyone except Salve Regina information sessions talking about the value of the education that they would provide. I remember Salve telling us not to look out the window at the beautiful ocean view, that if you were not here to work, that this was not the right place for you. That is why we came. We need a high quality education that will enable us to find jobs when we graduate.

President Obama has proposed his plan to make college more affordable, but it has already met a great deal of criticism. The White House website states that, “The federal government provides over $150 billion each year in student financial aid, while states collectively invest over $70 billion in public colleges and universities. Almost all of these resources are allocated among colleges based on the number of students who enroll, not the number who earn degrees or what they learn.”

The President is proposing a new college rating system that he believes will help, basically by moving to a system that allots federal dollars based on how many underprivileged students graduate. The president’s plan breaks it into three main measures: percentage of students receiving Pell grants, affordability (such as average tuition, scholarships, and loan debt), and outcomes (such as graduation and transfer rates, graduate earnings, and advanced degrees of college graduates). To help students and graduates who are struggling with their payments, the President has created a Pay As You Earn plan that limits the payments at 10% of the borrower’s income. The problem is that the President’s rating model can easily be abused. The result could be that colleges that recruit based on academic achievement and offer scholarships to those students would no longer have the ability to do that. You can quickly imagine colleges recruiting students based on low income rather than merit, and that those students could be pushed through graduation to keep the federal ranking and federal dollars coming.

Perhaps a better model may be the College Education Value Compared Payscale Return on Investment Survey that rated 1500 U.S. “colleges and universities, including private, public and for-profit schools, to determine the potential financial return of attending each school given the cost of tuition and the payoff in median lifetime earnings associated with each school.” (You may be happy to know that Salve Regina University made the list at #895). Another option could be a hybrid that includes a “happiness” rating along with ROI. Past graduates could be asked if they were satisfied with the value of the education they received; whether they were prepared for and working in the field of their choice; if they received career development and job search help; if they would recruit and hire from their alma mater; and maybe most importantly, would they send their children to the schools they attended.

-Patrick Flynn